In the period 2016-2020, Vietnam’s electrical and electronics industry reached a strong development, on average, during this period, the index of manufacturing electronic products, computers and optical products increased by 14.94%, in which the highest increase recorded in 2017 was 32.7%.

The IIP in the first 8 months of 2021 compared with the same time of 2020 of Manufacture of electrical and electronics products, computers, optical products and Manufacture of electronic equipment sector increased slightly compared with the same period in 2020 (7.8% and 3.3% accordingly).

In fact, Vietnam’s electronics industry currently only assembles parts and does simple production processing; in term of production of components or specialized devices, Vietnam still have not yet made any big achievement. The significant development of Vietnam’s electronics industry in recent years is mainly reflected in the attraction of large investments from multinational corporations, especially those from Korea and Japan. FDI projects in the field of electronics manufacturing account for 95% of the total export turnover of this industry.

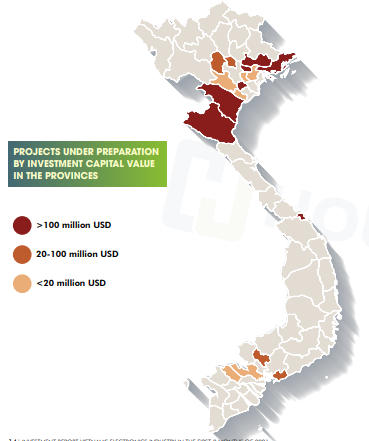

In 8 months of 2021, there were 33 electrical projects have been licensed. The total registered investment capital reached more than 1.7 billion USD. In which, These figures have shown that, the Northern market still attracted more projects with bigger size and more than 70% projects located in the North both in term of quantity and registered capital value.

Bac Ninh is the province with the largest number of projects among newly licensed projects in the first 8 months of 2021, but the project scale is not too large. In which, most of the large-scale projects located in Quang Ninh. Quang Ninh also ranked second in the number of registered projects. Except for Quang Ninh, the remaining provinces in the top 5 projects in terms of quantity and value of registered capital are not the same. While projects are concentrated in Bac Ninh, Binh Duong, Ha Nam, and Long An, large-scale projects are concentrated in Phu Tho, Nghe An, Bac Giang, and Thai Binh.

According to the Mr. Nguyen Ngoc An, President of New Cc Construction Consultants Co., Ltd , Vietnam’s electronics industry in recent years has achieved strong growth that is attractive to leading electronic investors such as Samsung, Foxconn, LG, etc., for a number of reasons:

Firstly comes from the demand side: The registered and disbursed capital of FDI investors into Vietnam has continuously grown and maintained at a high level in the past 10 years. Many large investors are still pouring capital into Vietnam to take advantage of the advantages: Low investment costs, abundant and competitive labor, many tax incentives and opportunities to access many large markets through FTAs. Especially, Vietnam’s industrial production has accumulated and completed many important supply chains such as electronics, textiles…

Besides, the wave of investment shift from China in the past 3 years is still ongoing and the pressure is on to diversify the supply chain to spread the risks caused by the Covid-19 pandemic. Leading to investment demand and supply chain shifting is taking place strongly around the world, in which Vietnam is one of the current hot spots.

The outbreak of COVID-19 worldwide has caused a decrease in production, especially in Asian countries, including a sharp decrease in the supply of electronic chips. Not only in Vietnam, but also Taiwan (China), Korea… are trying to increase production capacity or build new factories to continue to meet this demand. Recently, large enterprises such as Samsung, TSMC, and Intel have poured hundreds of billions of dollars to open new chip factories to increase production. This will affect the entire supply chain behind. So that’s the story, businesses are waiting for the chips to be manufactured and they are starting to be willing to pay more for their chips. So this also opens up a new challenge and opportunity, if Vietnam can accelerate the recovery process after the epidemic, this will be a great advantage of Vietnam compared to other countries in the region.

Source : Viet Nam’s Electronics Industry Investment Report – HOUSELINK